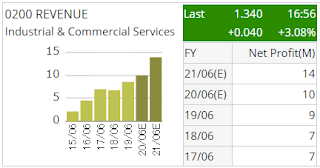

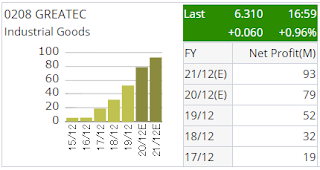

Despite the current relatively soft rental market, it is still possible to have above-average rental return for your invested new condominium / apartment unit.

I am sharing the tips below based on my own experience, which worked well with me, and hopefully will work with you too.

Tip #1: Choose lower unit when buying new condominium / apartment

It is a common developer's practice that the higher the floor, the more expensive will be the unit of the same layout type.

Higher floor has better scenery view, which can see further away. If you save your cost on this by buying a lower unit, you can use the saved money to do better renovation, and also to furnish the unit with more furniture and electrical appliance.

In addition, lower unit is normally nearer to the car park and also to the Ground Floor. In the event of a long waiting lift, or lift under maintenance, you have the advantage of using the staircase to reach your car park or Ground Floor, without having to walk down too many floors.

This is also of advantage to your tenant during fire drill exercise, as there will be fewer floors to walk down to the evacuation area.

Tip #2: Choose a unit that less likely to be blocked by neighbouring building

When you choose your unit, make sure that it's view won't be blocked by neighbouring building, either presently or in the future.

This is because blocked unit has much lesser scenery view, less privacy as it can be seen from the other building, and dimmer sunlight.

You can ensure that your view won't be blocked by future development by choosing a unit that is facing the sea, or a lake, or a river, or low-rise landed properties, or golf field. Avoid facing a vacant land, which you won't know if there is another high-rise building erected in front of you in the future.

Tip #3: Choose smaller unit with 2 bedrooms or 3 bedrooms

Smaller unit has a cheaper selling price than larger counterparts in the same building. As the building maintenance fee and sinking fund is directly proportional to the area taken by the unit, you can also enjoy a cheaper monthly maintenance fee and sinking fund by investing in a smaller unit.

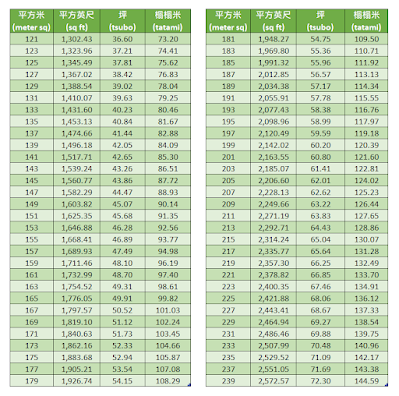

The ideal size is between 800 sqft to 1000 sqft. Depends on the floorplan layout, it is possible for you to partition a 2 bedrooms unit into 3 bedrooms. If that is the case, you will be of more competitive advantage to invest in a 2 bedrooms unit, having the option to convert it into a 3 bedrooms unit if required by your tenant.

Smaller unit is easier to get tenant who are either individual, couple without kid, or small family. You will have better bargaining power on the rental price, since your cost is lower.

For larger unit, your demand will be from larger family, or you will need to allow for sub-renting. Otherwise, since your cost is higher, if you are not willing to lower down your rental price to be on par with the smaller unit's rental price, it will be more difficult for you to secure a tenant.

Tip #4: Choose corner unit

Based on my own experience, usually the smaller units in a condominium / apartment are also corner units.

Chosing corner unit has the following advantages:

- You will have more windows, brighter sunlight, and more external views.

- All your rooms are likely to have external views. For intermediate units, it is common that one or more rooms will have corridor view, or even without any window.

Tip #5: Choose a bare unit

Certain development projects allow buyers to choose whether to let the developer to furnish the unit with built-in furniture and kitchen appliance, or to leave it as bare unit.

For investment purpose, it is strongly advised to go for bare unit, because:

- Every developer renovated unit will have same type of furnishing, making them look the same to the potential tenants who view the unit. There will be no difference and uniqueness.

- You can't control the quality and material used by the developer's contractor who furnishes the unit. In many occasions, I found people complained about substandard furnishing they got, and they regretted for not choosing a bare unit.

- By having a bare unit, you have good control on getting your trusted renovation contractor and/or interior designer to provide good quality furniture and fitting, nice looking design, and having a unique design different from other units. You also avoided the situation of having portion of standard renovation that you dislike.

Tip #6: Make sure your unit's electricity tariff is of residential rate

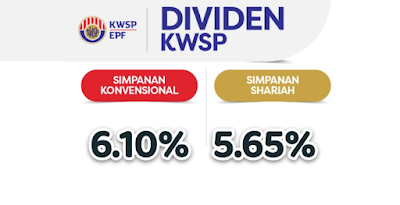

If you are buying a residential unit in a service apartment, it is very likely that your electricity tariff by default is of commercial rate, which is much higher than the residential rate. You can apply for the tariff conversion online pretty easily by following the steps as written in this article.

Your tenant will be happier to know that the electricity tariff of your unit is of residential rate rather than commercial rate.

Tip #7: Renovate and furnish your unit into fully furnished or close to fully furnished

This is the key of getting a relatively better rental than your neighbours in the same building. Your unit needs to make a difference and need to be more tempting to your potential tenant.

Your renovation and furnishing need to be practical for daily living. You need to supply your tenant with all the daily living essentials, such as ceiling fans, air-conds, sufficient lighting, refrigerator with sufficient capacity, washing machine, drying machine (if it is difficult to find place to dry clothes with direct sunlight), kitchen cabinets, wardrobes, etc.

Although you might not need to choose to supply with high-end electrical appliance, it is better to provide good quality and branded one. Firstly, they are more presentable to your tenant. Secondly, the chances of breakdown are probably lower, and in case of warranty service is needed, you are likely to have better after-sales service from branded products.

It is a very good selling point if you could make your unit a comfortable and convenient place to live in, with the comfy feel of "home" to your tenant. It needs to be presentable and honorable for your tenant to welcome his/her guests visiting to your unit, a.k.a. your tenant's sweet home.

To give you an idea, below are 2 pictures of the kitchen area of 2 of my invested units respectively.

Tip #8: Take nice photos and videos to advertise your unit

Whether you want to rent out your unit by yourself, or through property renting platform such as SpeedHome, or using property agents, you need to take nice photos and videos to advertise your unit.

You will need altogether 3 sets of photos and videos:

- Your unit

- Highlight your unique selling points.

- Highlight what's your difference compared with other units.

- Highlight its security features, such as: digital door lock, invisible grilles, etc.

- Highlight its privacy features, such as: curtain & blinds, soundproof, etc.

- Provide good impression to potential tenant to fell that "this is the comfy home to live in".

- Your condominium/apartment

- Highlight your building's unique selling points compared with other neighbouring buildings.

- Highlight how presentable is it to visitors - parking, visitor waiting area, OKU considerations, etc.

- Showcase the common facilities - swimming pool, sauna, gym room, children playground, recreational facilities, sports facilities, social facilities, etc.

- Showcase the security and privacy.

- Showcase the convenience.

- Showcase the friendliness of residents, quality of management office and security guards, etc.

- Interesting events, functions and happenings in your community - festivals celebration, parties, marriage occasions, BBQ, educational events, etc.

- Available high-speed broadband Internet service providers, the more choices the merrier - UniFi, Time, Maxis, Astro, Fiber@Home, etc.

- The nearby surroundings of your condominium/apartment

- Convenience stores

- Eateries and restaurants

- Sport facilities - badminton, tennis, basketball, volleyball, soccer, golf, stadium, etc.

- Recreation places - parks, lake, riverside, hiking route, etc.

- Clinics and shops

- Marts, morning market, night market, ...

- Shopping mall, commercial area, banks, ATM machines, ...

- Kindergartens, schools, colleges, universities, daycare centres, tuition centres, ...

- Medical centre, hospitals, police station, fire brigade, ...

- LRT/MRT stations

- Traffic condition

- Surrounding community

With all these in place, I believe you will be able to get a good tenant with a good rental return too.